Stephan Hassenpflug

Born 1977

This is my personal perspective on financial systems and asset preservation. I'm not a financial advisor—just someone who learned these lessons the hard way and wants to share what I wish I'd known earlier.

What I wish someone had taught me 10 years ago about money and assets

Born 1977

This is my personal perspective on financial systems and asset preservation. I'm not a financial advisor—just someone who learned these lessons the hard way and wants to share what I wish I'd known earlier.

For years, I saved money in traditional bank accounts, thinking I was being responsible. But I watched my purchasing power slowly erode. The modern financial system has a fundamental flaw: central banks can print unlimited currency. What took me decades to understand is that the US dollar, once backed by gold, now operates on faith alone. This isn't conspiracy theory—it's how the system works, and I wish someone had explained it to me in my twenties.

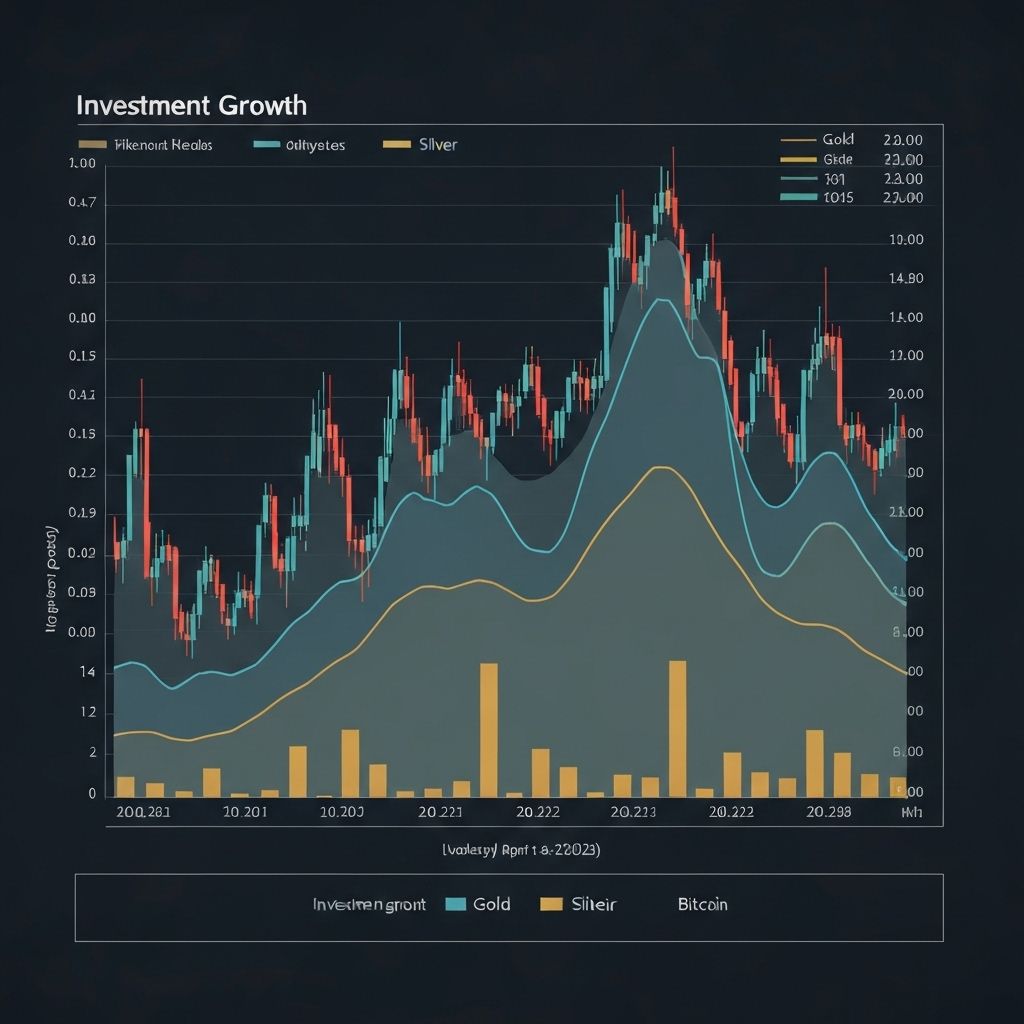

The United States is now exploring Bitcoin strategic reserves and asset-backed currency systems. This represents a massive shift in thinking. Bitcoin is scarce, verifiable, and can't be printed at will. Whether you believe in it or not, major governments are taking it seriously. I'm not saying put everything into Bitcoin, but ignoring this shift would be like ignoring the internet in 1995.

How many ounces of gold, silver, or Bitcoin would it take to buy an average American house?

This comparison changed how I think about money. The dollar price of a house increased 18x since 1970, but you need 76% less gold to buy the same house. Bitcoin shows even more dramatic results. This isn't financial advice—it's just math. The dollar loses value over time, while scarce assets tend to preserve or increase purchasing power. I wish I'd understood this in 2005 instead of 2015.